Whether certifying products, sharing claims or optimizing and decarbonizing supply chains, DNV helps companies manage risks and realize their long-term strategic goals, improving ESG performance and generating lasting, sustainable results.

Combining sustainability, supply chain and digital expertise, DNV works to create new assurance models enabling interaction and transaction transparency across value chains. Drawing on our wide technical and industry expertise, we work with companies worldwide to bridge trust gaps among consumers, producers and suppliers.

Services & solutions

Supply chain governance

Manage risks and realize long-term strategic goals, improving ESG performance and generating lasting, sustainable results.

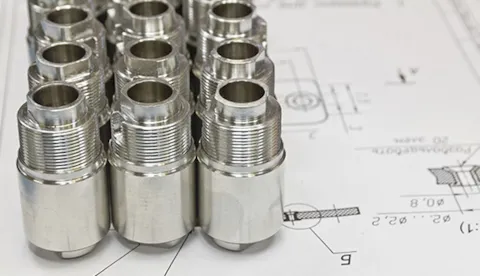

Product Assurance

Product certification and compliance is vital to prove product quality, and is often a ticket to trade.

Sustainability Report Assurance

Sustainability Report Assurance

DNV - Supply chain and product assurance

The organization and management team.